Cash Vs Investing

Reading Time: 5 minutes

In light of the higher interest environment and investment landscape, this Client Briefing aims to shed some light on the differences between holding money in cash deposits vs diversified global investing.

In our view, the most effective definition of money is future purchasing power, in as much as it is only good to the extent that it can buy more in the future than it can today. This then highlights the major risk that should be focussed on, inflation.

Inflation corrodes the purchasing power of your money and our investment philosophy and recommendations are centred around protecting the value of your money in the years to come.

Our recommendations are based on the strategy that we believe will provide the greatest protection against inflation, based on your objectives, with a lesser focus on the ever present ‘risk’ of day-to-day and year-to-year volatility, which is a part of the system, rather than a defect in it.

The recommendations we make are on the basis of what action has the highest degree of probability, based on the information we have, to provide the returns you require to achieve your objective and mitigate the effect of inflation.

Cash rates are ‘attractive’ – why should I invest?

Over the last 24 months, the global investment landscape has changed dramatically, and central banks have increased rates successively as their primary tool to slow down global economic growth and therefore decrease inflation. These central bank interest rates are the primary datapoint which dictate the interest rates for all types of debt, in this instance coming in the form of the short-term debt that powers the return of interest on savings accounts.

Traditional high street savings accounts, whilst ‘secure’ and offering some tempting headline rates (5% at the time of writing for an easy access account), would appear to currently offer a stable alternative to traditional global investment, albeit still being eroded by inflation. But when you widen the lens out to longer periods you can start to see how ineffective cash has been at providing protection against the big risk of inflation.

A graphical representation of this can be found below depicting a comparison against CPI Inflation of Global and Balanced benchmarks, against Money Market Funds. Money Market Funds are akin to holding cash at the bank and as you can see over the past three decades have provided no protection against inflation vs both the Balanced and Global Equity benchmarks.

You may question that your time horizon is shorter than three decades, but when we view this information over the past 5 years the picture looks even bleaker.

Source: FE Analytics, 28/07/2023

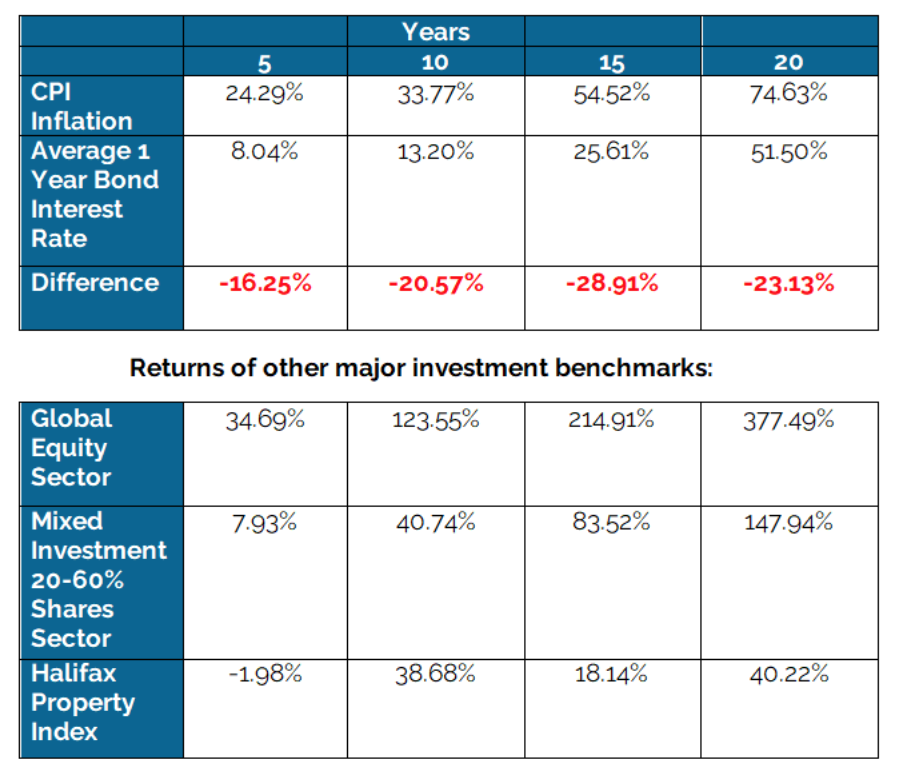

To show this comparison in another way below is a comparison of the average interest rate for 1 year bond cash accounts vs a range of time periods and different investments.

Cash Vs Investments – The Key Differences

With the above information in mind it is also important to understand why the difference in outcomes is so varied and what is driving the different rates of return.

The key difference is that the only way the capital value of cash can increase is if the interest received is added back to the initial deposit. Whereas with an investment, for example shares, both the capital value of the share can rise (and fall) and there may also be an income stream for continual reinvestment, for example a dividend or yield.

Cash

When money is held on deposit, only a small portion is held by the institution offering the account and interest. Their role is to take your money and either offer it out in the form of loans, in the main at a higher rate of interest, or investing the money themselves, and in some instances using your deposits as leverage to increase their investing capability. In simple terms you are a lender to their business model to make higher returns.

Investments

If we use a diversified equity portfolio as an example of an investment for comparison to cash, you are an owner of a real profit producing, productive company, offering a product or service to consumers and, when done correctly, providing a positive future cash flow. Profits are then either reinvested to new projects or distributed to shareholders in the form of dividends, which can also be reinvested to benefit from any rises in the capital value. It is the underlying model of a business to produce profits that provides its inflation protection. Business profits rise due to innovation and the ability to pass on price increases to the consumer and this then means that over time the dividend income can increase. It is this engine of innovation and improvement for great companies of the world that provides the ability for inflation protection. In comparison, cash cannot change and innovate in a high inflationary environment, although the bank that has received the deposits can, and will, with consumers’ deposits.

Actions & Next Steps

So to the actions from this Client Briefing:

1) Recognise that cash has its place in any financial plan and even when interest rate are low your return comes in the form of the protection and security against life’s unplanned events. By always having a cash reserve in line with your requirements you will have no need to sell down any invested assets and interrupt the long term power of compounding.

2) Review your income and expenses and define the money you require as a cash reserve.

3) When you have defined your cash reserve, consider if it is working as hard as it could be for you. We have recently started using the service of Insignis cash management for this purpose. Click here for an introduction to their services. Should you require any further detail on this service then please contact theteam@monentipartners.com

https://www.insigniscash.com/how-it-works

4) Consider the tax implications of any asset and its effects on return. Interest above any savings allowance is taxable and this should be taken into account in the overall effect of the ‘return’.

5) Ask the question ‘What is it about investing that I don’t understand or need to know more about to benefit from it?’. Your financial planner will always be on hand to answers these questions. In our experience successful investing is more of an emotional/behavioural matter rather than a purely intellectual one.

Sources:

Savings Champion – https://savingschampion.co.uk/, 21/08/2023

This Briefing is intended only for clients and prospective clients of our practice. It is designed to inform, educate, and entertain. It does not constitute advice. If you would like a detailed discussion of your financial planning, or any other point raised here, then please do not hesitate to contact us. Please note that past performance is not necessarily a guide to the future and investors may not get back the amount originally invested as the value of any investment and the income from it is not guaranteed. The Financial Conduct Authority do not regulate taxation advice. The tax treatment of investments depends on individual circumstances and may be subject to change in the future. The value of your investments can go down as well as up, so you could get back less than you invested. A pension is a long term investment. The fund value may fluctuate and can go down. Your eventual income may depend on the size of fund when accessed, interest rates and legislation.

The value of investments can go up as well as down, so you could get back less than you invested. This website and its content do not constitute advice, and our services are designed for those resident in the UK.

Monenti Partners Ltd is a company registered in England under number 06299795 Registered office address Littlemead, Hollingdon, Leighton Buzzard, England, LU7 0DN

We are Independent Financial Advisers authorised and regulated by the Financial Conduct Authority (FRN) 485058.