The Wall of Worry

Reading Time: 7 minutes

Standing Guard at the Door of Our Minds

Earlier in the month, when considering our next Client Briefing and its contents, we debated the value of sharing information relating to the recent Spring Budget announcements. The changes made in this budget, especially relating to Pension savings, will affect a great number of our clients. However, generic information on the changes will not assist our clients in their journey towards Financial Freedom.

We wish to continue to ensure that any content that we provide is relevant and actionable, rather than adding to the noise that many media channels and financial outlets provide. The decision we have taken is to refrain from generic budget updates and instead focus our time on tailored advice related to an individual’s circumstances.

That leads us to the subject of this Client Briefing, the aim of which is to stress the importance of filtering the information that we consume, and to consider its effects on our financial futures.

The below graphic depicts what we call the Wall of Worry. A timeline of real world events overlayed on the movements of the global stock market (noting the trend from left to right).

Source: MSCI/Humans Under management, March 2023

The events outlined had significant global consequences and should be by no means discounted, but focussing on this information, which in the main you would consider ‘negative’ could have dire consequences for an individual investor’s success.

The Amygdala

Let us first consider how the brain processes information and events.

Let us first consider how the brain processes information and events.

Our brain, notably the Amygdala, commits our experiences to memory. We actually have two Amygdala. The Amygdala on the left side of our brain deals with both positive and negative events, however the right Amygdala only processes negative events. This difference can skew our memories and how they are stored.

If every positive event is only recorded by half of the brain, we end up needing THREE TIMES as many ‘good’ things to happen to us as ‘bad’ things, just for it to seem balanced. This bias is the way we view the world and keeps us cautious by nature, which from an evolutionary standpoint is of course important, for example helping us consider standing close to a ledge or walking down dark alleyways. The issue lies when we overlay the 21st century, where so much is different to when our brains were forming. There are many things that although not life threatening, can still be considered extremely scary.

Nowhere can that be more true than when it comes to one’s finances. There is always something that you could worry about, or a headline that can grab you away from reality.

What can we do about this? Strategies and Tactics

The guidance here is threefold and centred on the idea that WE MUST STAND GUARD AT THE DOOR OF OUR MINDS.

1. Knowing the above we can be conscious of it. It is completely natural to have feelings of worry when it comes to investing and even seasoned investment professionals (whatever they tell you) will have those feelings as well. It is what you do with those thoughts and feelings that is the most important factor, and how you let them control your financial decisions.

2. Get some context. Taking into account the information regarding how positive and negative events can skew one’s memories, looking less frequently at the markets and the performance of one’s portfolio will help here.

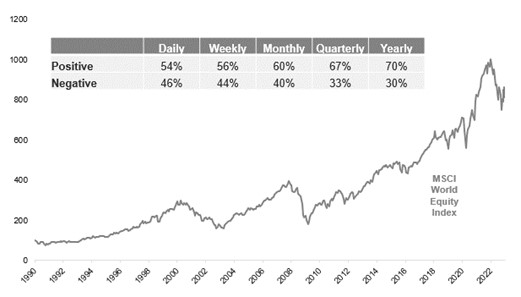

The below graphic again focuses on the global stock market, depicting the Positive and Negative days of returns. On a daily and weekly basis you can see that close to 50/50 of returns are Positive and Negative, but as we start to zoom out we get closer to the long term trend, which looks far more healthy.

Source: 7IM/Bloomberg Finance LP, March 2023

Knowing that in the short term the stock market is a voting machine and in the long term it is a weighing machine can be incredibly powerful.

3. In the short term we cannot control biology, but we can control the information we feed our brains.

It must be remembered that in the vast majority of cases, news must sell. Whether that be for pounds and pence or subscribers.

If we allow the barrage of mainstream media to inform our investment decisions then we will start making decisions based on the crowd, and it is that very mentality that can be so dangerous – or GIGO for short (garbage in, garbage out). If you want different results then you must go against the crowd, which of course can be difficult as we look for security in the crowd.

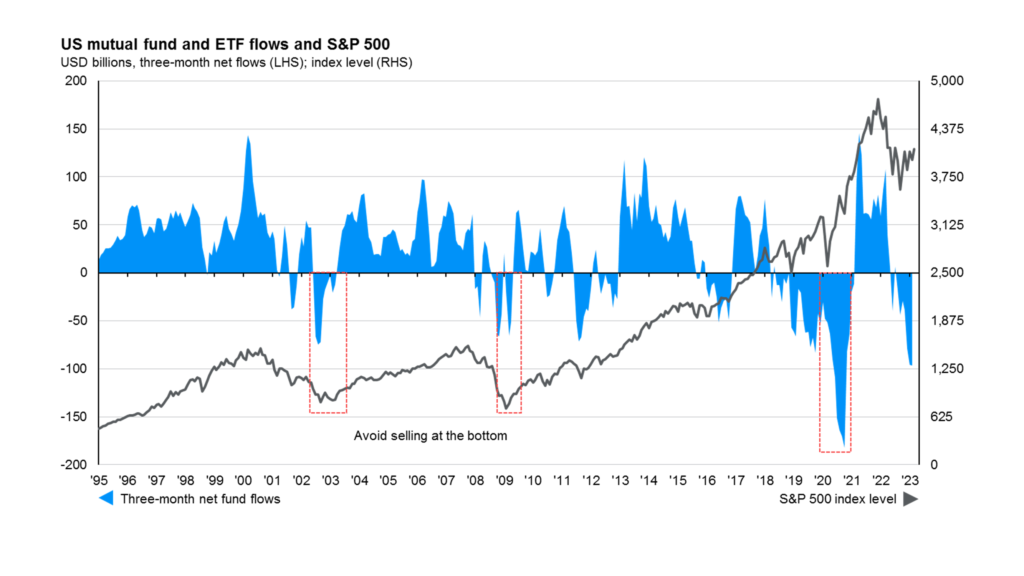

In short, we must buy investments whilst the markets are going down and sell whilst they are going up.

The below graphic predicts the S&P 500 (grey line) stock market and in blue the inflows (net buyers above the line and net sellers below the line) into the US Stock Market. What is depicted shows time and again investors selling at the lowest bottom point only to reinvest back into a rising market, thus following the crowd.

Source: JP Morgan, March 2023

Some key ideas to remember when filtering the news and information you are consuming are set out below:

1. Don’t consume information without purpose.

- Another area of our brain is the Reticular Activating System (RAS), which is key to deciding what we focus on and what we deem important.

- The information that we consume, if it does not have a purpose, will be filtered by the RAS and deemed important.

- Thus it is always important that the information and advice we receive has a purpose and relevance to our objectives.

- Whatever you feed your brain it will focus on. Be selective and have a plan.

2. Ensure you don’t have an information deficit.

- Do you know the subject matter upon which you are trying to make decisions? If not, who could provide this context?

- This is where Monenti Partners as your trusted partner in your financial planning can step in, and is one of the key roles you have chosen to delegate to us.

- Finding someone that is already getting the results in this area can be key.

3. Stay away from information pollution.

- Advice can be the cheapest commodity available.

- In the information age it can be easy for an individual or news outlet to provide what they may deem good advice, but without knowing your personal circumstances it should not be deemed advice at all. Advice can only take into account your personal circumstances and be provided by a regulated adviser.

- We should also consider that the provider of information may have a financial interest for themselves in providing the information or grabbing your attention. For example, to increase newspaper sales, or increase their followers.

- Many can only touch the surface of a subject. Many will be sincere in their writing, but can be sincerely wrong when it comes to your personal circumstances.

4. Information overload.

- This element goes back to the start of this Briefing. At Monenti Partners we do not wish to add to the barrage of information that is shared on a regular basis, which can be easier said than done in this information age.

In short be aware that your thoughts, and the decisions we make from them, are controlled by aspects of our brains that may not be as developed as we believe them to be. As such it is imperative that we screen the information that we let into our minds and note how this may affect our investment decisions.

The value of investments can go up as well as down, so you could get back less than you invested. This website and its content do not constitute advice, and our services are designed for those resident in the UK.

Monenti Partners Ltd is a company registered in England under number 06299795 Registered office address Littlemead, Hollingdon, Leighton Buzzard, England, LU7 0DN

We are Independent Financial Advisers authorised and regulated by the Financial Conduct Authority (FRN) 485058.